20 Nov

Becoming a Sole Trader in Ireland

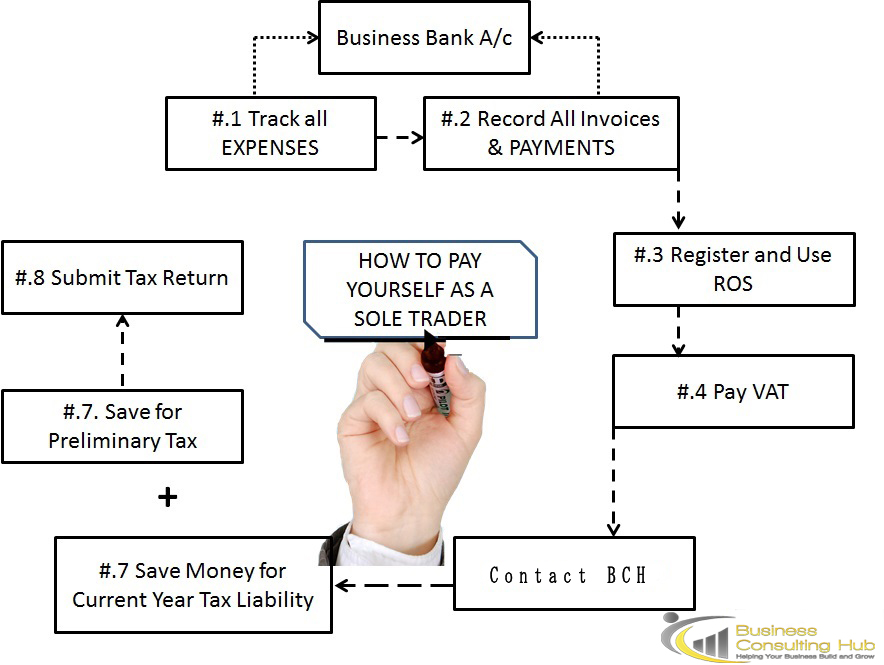

There are various steps that you must complete to become a Sole Trader in Ireland and start your company. This article will explain how to register for tax, what taxes you will pay, how to get a Personal Public Service Number (PPSN), how to register for VAT, things you need to keep in mind, where to register your company’s name, and where to go to register as a “Self-Employed” person.

Register Your Company’s Name with the CRO

You need to register a company name if it differs from your first or last name.Search for your potential company name on the Companies Registration Office (CRO) to make sure that it is not already in use.Submit a RBN1 form and the registration fee (€40 for paper filing or €20 for electronic filing) to the CRO within one month of adopting your business’s name.

Register for Income Tax, USC Tax, and PRSI Tax by Self-Assessment

You need to use “Self-Assessment” when you register for tax, which is your personal assessment of your Income Tax (IT), your Universal Social Charges (USC), your Pay-Related Social Insurance (PRSI), and any Capital Gains Taxes (CGT) for each year. You may use your Self-Assessment on the Revenue Online Service (ROS) or through Revenue.ie if you have an account. Your total income from your company’s profits may be taxed up to 52%. File Income Tax returns and pay any tax liabilities by October 31st of each year.

Get a Personal Public Service Number (PPSN)

You need a PPSN if you want to be a Sole Trader in Ireland. A PPSN is a seven-number reference with one or two letters that gives you access to social welfare benefits, public services, and information in Ireland. You need a PPSN to register with Revenue Commissioners if you are going to be employed.Here is a list of things you can use your PPSN for:

- All social welfare services

- The Free Travel Pass

- Pupil I.D

- Public health services, including the medical card and the Drugs Payment Scheme

- Child immunization

- Revenue Commissioner schemes

- Housing grants

- Driver Theory Testing and driver licenses

Register Yourself as a “Self-Employed” Person through the Revenue Online Service (ROS)

Use the Revenue Online Service (ROS) to register yourself as a “Self-Employed” person.

Key Points To Remember

As a Sole Trader, you are the owner of your business and are liable to any damages, debts, and penalties that you may get. Your personal assets will be taken to compensate if your company winds up or fails. You must keep records and files of taxes, Annual Returns, and other legal documentation, and you are responsible for these documents and for your potential employees.

Register for VAT

If your company has a turnover of over €75,000 from selling goods or €37,500 from service sales, then you must register for Value Added Tax (VAT). The standard VAT rate for goods and services is 23%. Register for VAT through the Revenue Online Service (ROS) and fill out the TR1 form for individuals. Registration will be effective after Revenue receives and approves your application.